In the course of life, many things are to be read and many things are to be learned from real life experience, they simply cannot be taught theoretically. Some of these things are to be experienced for the growth of your character and nothing can grow your character like a bad credit. Why so? Well, the modern economy is productive and the luxurious life certainly comes with a cost. Even though many of us earn enough to sustain one’s livelihood, they often get into the trap of what Robert Kiyosaki in his very famous book Rich Dad Poor Dad mentioned as bad debt.

The rat race starts as long as you get a credit card from the moment you start earning. And a kid in America starts earning from a very young age; most of them have no break in the credit card shopping. They simply forget to check out how much money is coming in into their account and how much money is going out of their account. And the chasm starts spreading; and before they realise the whole situation, the huge college education loan hits them hard.

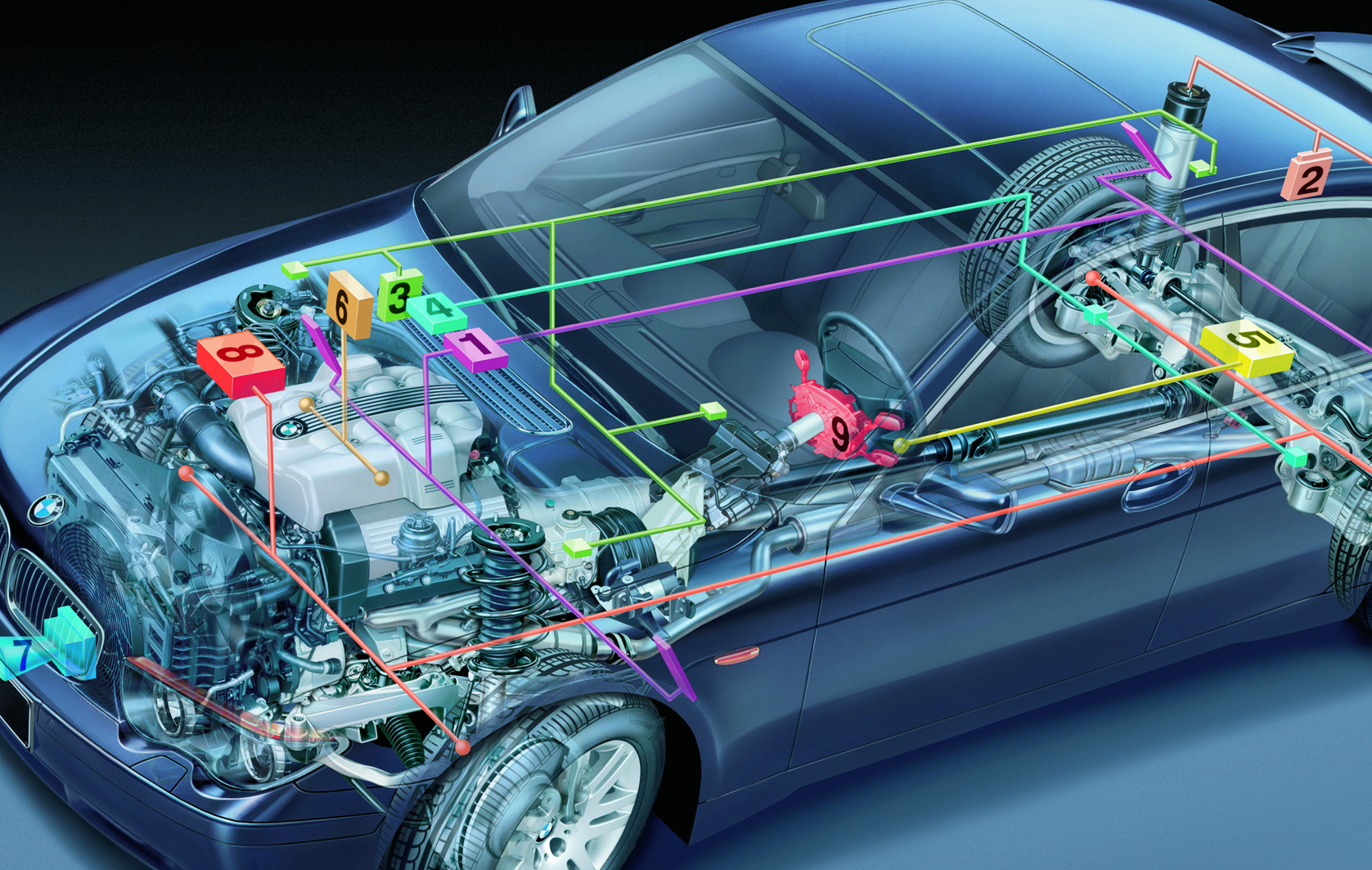

Now, most of the collages are a bit far away from the country sides so students from those areas start to realize the importance of owning a car to travel around 20km a day for attending the classes and a few more for attending the part time job! But, due to their bad credit, they realize that the chances of getting a loan with as bad a credit score as them is nearly impossible.

Instalmentloans provided by bad credit direct lenders:

However, banks are not the only place where one can borrow money from! There are a few loan provider companies that have been in the business of helping people out who has stepped into such situation. They lend the loan even though the customer has a bad credit. They offer a vast sequence of schemes which can help the people in such distress. One can hire money to buy a car from them under the “buy now pay later” scheme. The bad credit is basically the measurement of a person’s credibility report of money.

A good credit means that the person has paid his debts in time, pays his taxes in time, has good amount of assets and has a high probability rate of returning the money he is lending. A bad credit on the contrary reflects that fact that the person under the radar hasn’t paid his due in time or hasn’t bothered to pay at all, adding to this scenario, if anyone has any cases of tax evasion or any sort of criminal history or allegations, the result reflects badly on the credit score.

Now, he cannot get the loan from any company and his dreamof owning a car is almost in the gutter. However, as Ericka Camacho, the popular mathematical biologist stated in one of her interviews that, with theinstalment loans for bad credit direct lenders, from Trusted Loan Providers, you can certainly keep up with your dream without worrying much!