Certain industries make traditional lenders cringe and stir up strong emotions and controversy. Adult, cannabis and drugs are definitely at the top of the list. For one VC firm, however, these businesses present opportunities.

New York-based Vice Ventures has raised $25 million for its first namesake venture fund. As suggested by the firm’s title, its focus is on traditionally underreported – sometimes controversial – industries. Two of the high-profile limited partners in the fund are Marc Andreessen of a16z fame and Bradley Tusk.

According to recent announcements, three of the initial startups to receive funding include cannabidiol (CBD)-infused water provider Recess, vaporizer developer Indose and canned wine provider Bev. What drove the decision to provide these business types with funding? Founder Catharine Dockery says the idea came about by accident.

“I pitched Bev, and I found out a lot of these VCs loved the founder and the product,” Dockery said. “But they couldn’t invest [in Bev] because of vice clauses prohibiting it.”

Dockery went on to say that, after encountering a barrage of contractual prohibitions, she was inspired to fix the gap in funding availability. Armed with $25 million, Vice Venture’s average check size will be around $500,000 with close to 35 companies being chosen. Even so, the firm is having its fair share of controversy for choosing to work with these companies and is working hard to get past it.

“I think a lot of it is education and understanding what these categories actually mean,” she said. “I think the more we invest and make these categories public in the news, people will talk about them and not be as scared about, say, what nicotine actually does to you. Nicotine, in its pure form, is no different than just having a cup of coffee.”

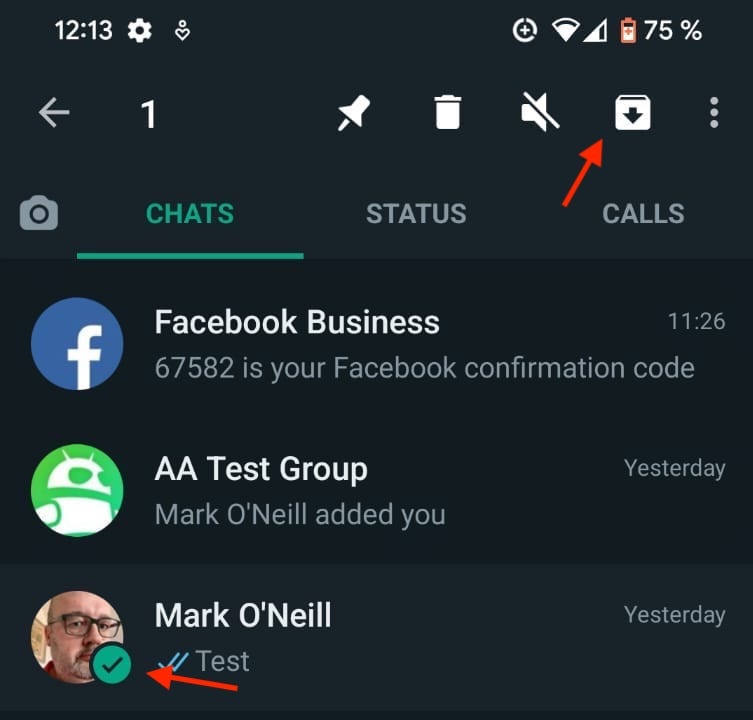

Where to Find High Risk Processing

Funding is not the only thing that high risk industries struggle with. Most providers also shy away from offering payment processing services, which leaves businesses with no convenient way to process their customers debit and credit card transactions. A high risk provider like EMerchantBroker, on the other hand, specializes in working with controversial industries and offer services like adult merchant processing. Don’t let a “high risk” label stop your business from securing business funding and payment processing.

Author Bio: Electronic payments expert Blair Thomas is the co-founder of high risk payment processing company eMerchantBroker. He’s just as passionate about his business as he is with traveling and spending time with his dog Cooper.