Investing in real estate can be incredibly rewarding, but it also comes with both opportunities and risks. One of the primary challenges is understanding whether a particular property is truly a good investment. This is where a real estate roi calculator steps in, providing measurable insights into the performance of your properties. By delivering clarity and precision, this tool is becoming increasingly popular among real estate investors seeking to optimize their portfolios.

Understanding Real Estate ROI

Before exploring the benefits of an ROI calculator, it’s important to understand what real estate ROI entails. ROI is a metric used to measure the profitability of an investment. For real estate, it calculates the potential return relative to the cost of purchasing and holding a property. The formula typically involves subtracting total investment costs from net profits, then dividing the result by the total investment cost. While this seems straightforward, real-life scenarios are often more complex due to factors like mortgage rates, property taxes, maintenance costs, and market trends.

That’s where a real estate ROI calculator saves time and ensures accuracy.

Why Use a Real Estate ROI Calculator?

Accurate Performance Assessment

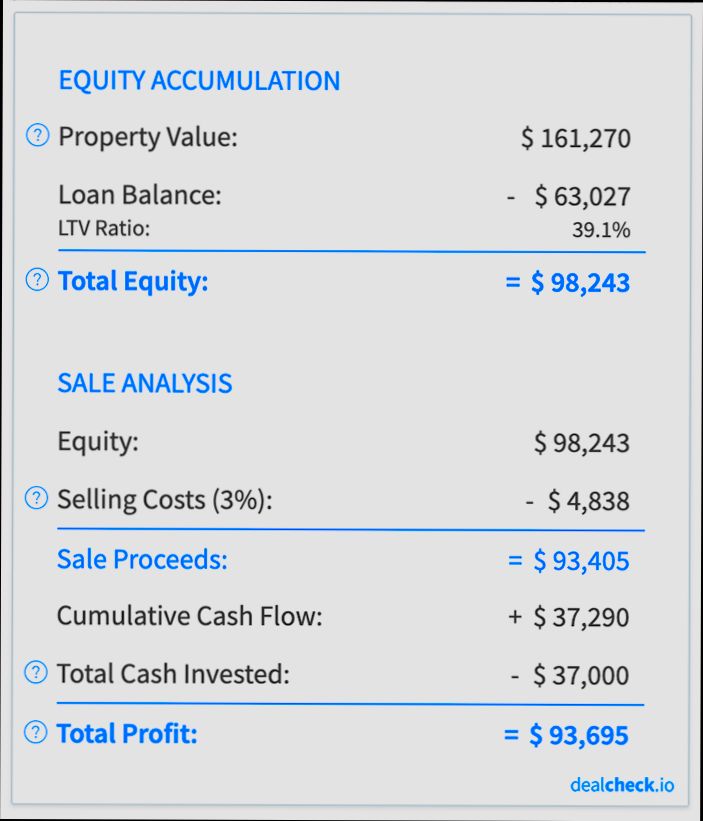

A real estate ROI calculator provides a detailed breakdown of how a property is performing financially. It accounts for multiple data points such as purchase price, ongoing expenses, rental income, and growth trends. Instead of relying on guesswork or piecemeal calculations, investors get an accurate view of returns over time.

This precision allows you to make informed business decisions. Should you keep, sell, or improve a particular property? An ROI calculator provides an evidence-based framework to answer such questions.

Saves Time and Reduces Complexity

Property investment involves numbers. Many working professionals and first-time investors can feel overwhelmed by the complex formulas often associated with ROI-based calculations. Manually performing ROI calculations can eat into valuable time and leave room for error.

With a real estate ROI calculator, the process is simplified. Simply input your details into the tool, and it calculates everything on your behalf in mere seconds. This efficiency allows you to focus on other important aspects of your investment strategy.

Tailored Insights for Specific Properties

Not all properties are created equal. Some may offer stable rental income but little long-term appreciation, while others might deliver significant appreciation with limited monthly profits. A real estate ROI calculator evaluates both short-term and long-term projections tailored to the specific property, allowing you to align properties with your investment goals.

Risk Mitigation

Every penny counts when it comes to real estate investments. Poorly performing properties or unexpected excess costs could drain your finances over time. By using an ROI calculator, you can identify possible weak spots in your investments.

For instance, if the calculator shows that ongoing expenses like maintenance or property taxes significantly eat into your potential returns, you can make moves to reduce these costs or reconsider your options. Ultimately, it acts as a safety net for financial risks.

Improved Decision-Making for Future Investments

Real estate ROI calculators don’t just analyze existing properties; they also provide clarity when evaluating future investments. Prospective investors can compare multiple properties by running simulations and tweaking variables such as price or rental income. This makes it easier to prioritize assets that align with desired metrics.